This post is also available in:

Français (French)

Français (French)  Español (Spanish)

Español (Spanish)

Loans on financial markets are different from express loans and have no impact on them. Thus, loans on financial markets allow you to borrow an additional amount.

How does it work?

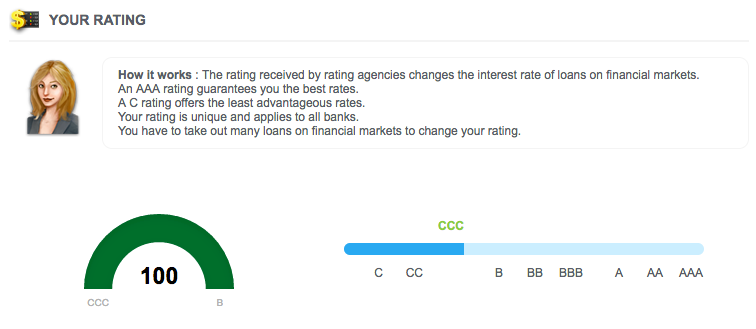

The management organizations of financial markets will assess your capacity to forecast your growth rate. To do so, you will have to forecast your SP on D+8. The more your SP estimate will be close to your SP on D+8, the more the rating you are given by your banks will change positively. The rating ranges from C to AAA:

How to make your estimate?

The estimate is based on two founding principles:

- You should never be under your estimate.

- You should avoid making too low estimates so that your estimate can be as effective as possible.

Let’s see an example:

Our airline is currently rated “AA” and our structural profit is $10,000,000. When we take out our loan, we estimate our future SP will be $11,000,000 (10% growth).

If our SP is $15,000,000 eight days later, rating agencies will positively assess our airline and may allow us to get an AAA rating. In our example, we earned 4 million “in excess” of our estimate. This $4 million margin won’t be included in the calculation. An SP estimate of $15,000,000 would have been much more effective, though much more risky.

In the same situation, if we have a SP lower than our estimate at the end of the eight days, $9,000,000 for example, rating agencies will negatively assess our airline, which may decrease the rating to “A”. Rating agencies will take into account there is only 1 million off, as a more important difference would have had much more serious consequences for our airline.

Evolution of the rating

You have to take out several loans to change your rating. Only one loan might not make any change, that’s why a chart shows your progress between two ratings.

The rating received by rating agencies for your airline changes the interest rate of loans.

An AAA-rated airline will benefit from much more advantageous rates than an A-rated airline.

The rating is specific to your airline and applies to all banks. For example: taking out loans that you have correctly estimated from the Minibank can change your interest rate in other banks.