This post is also available in:

Français (French)

Français (French)  Español (Spanish)

Español (Spanish)

Banks allow you to borrow money regularly to obtain new funds to invest in your airline.

Using banks is highly recommended for airlines which want to make their profits grow quickly.

You can unlock new banks via the General R&D. The more you have available banks, the more you will have means to borrow money.

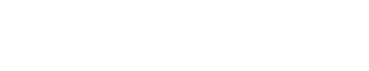

List of banks

Each bank shows a series of information that allows you to estimate if it’s interesting or not to take out a loan today:

- Interest rate: the interest rate depends mainly on the bank. Some banks have very low interest rates while others have much more important rates. The interest rate of each bank fluctuates every day, so it can be interesting to wait a few days before taking out a loan. The blue bar represents the current interest rate compared to the minimum and the maximum rates of the bank. The chart shows the rate’s fluctuation over the last seven days.

- Possible express loan: amount you can currently borrow with an express loan.

- Possible financial markets loan: amount you can currently borrow with a financial markets loan.

- Your current loans:

- Express: total of the express loans you are currently repaying for this bank.

- On financial markets: total of the financial markets loans you are repaying for this bank.

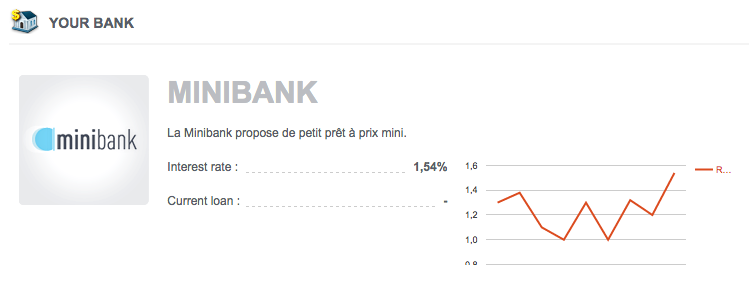

Express loan

The express loan allows you to borrow money quickly without asking for the financial markets’ assistance.

- Requested amount: you can ask the amount you want as long as it does not exceed the maximum amount of the bank.

- Weekly rate

- Loan period: you can choose the loan period, this will define the amount to repay every week. The possible period depends on the bank. The longer the loan period, the higher your initial interest rate. However, a short-term loan will have a more important impact on your structural profit.

- Financial charges: total cost of your loan depending on the interest rate. This amount is added to the requested amount to determine the total cost of the loan.

- Total cost of the loan: requested amount plus financial charges, this amount determines the weekly payment.

- Weekly payment: total amount you will have to pay every week to repay this loan. It is calculated from the total cost of the loan and the selected loan period.

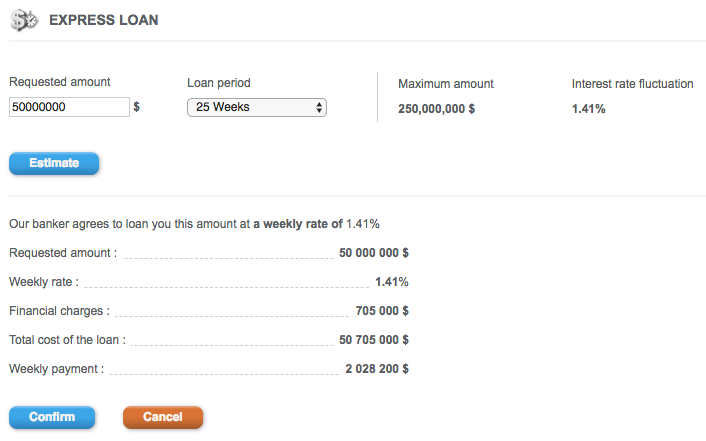

Loans detail

On this list, you can view all the loans taken out from a bank and the details of each loan :

- Done on: the date at which you have taken out the loan.

- Amount: remaining amount to pay for the loan.

- Rate: rate at which the loan has been granted.

- Loan n°: indicative number that can help you sort your loans if you use an external support such as an excel spreadsheet.

- Repay button: allows you to early repay the loan. When you click on the button, you are redirected to a page containing all the details about the loan.

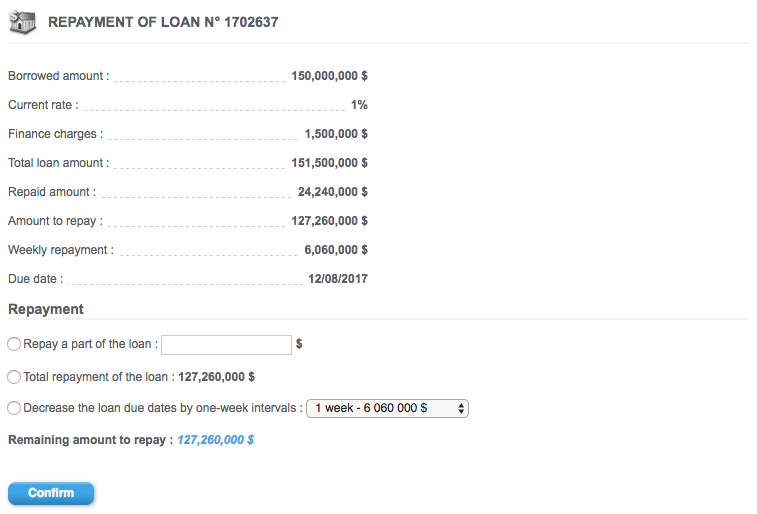

Repaying a loan

You can modify a loan by different ways:

- Repay a part of the loan: allows you to repay a part of the loan to reduce your weekly repayments for this loan.

- Total repayment of the loan: allows you to repay the total amount of the loan.

- Decrease the loan due dates by one-week intervals: allows you to change the loan period. Please note that this does not reduce the interest rate of the loan, that’s why it is recommended to choose the loan period carefully before taking it out.

A lot of information allows you to better manage a specific loan:

- Current rate: current rate at which you have taken out the loan.

- Financial charges: total cost of your loan depending on the interest rate. This amount is added to the requested amount to determine the total cost of the loan.

- Total loan amount: total amount you have requested when you have taken out the loan.

- Repaid amount: total of your repayments for the loan.

- Amount to repay: remaining amount to repay (Total loan amount – Repaid amount)

- Weekly repayment: total amount you have to repay every week to repay the loan.

- Due date: date at which the loan will be completely repaid.